TUGS & TOWING NEWS

ISKES EXPANDS ITS OPERATING HORIZON

Iskes Towage & Salvage is expanding its operational horizons by mobilising tugs in European markets. It moved its azimuthing tractor drive (ATD)-type tug, Arion, from Ijmuiden in the Netherlands to operate in the German port of Lubeck-Travemunde on the Baltic coast. Arion will be employed for assisting with the mooring operations of roro vessels sailing to and from the port of Travemunde. As well as working with these freight and passenger ferries, the tug will be used to assist the increasingly large cargo vessels calling into Lubeck. Iskes has also started operating in the port of Lisbon with effect from 1 January this year, in a joint venture with Rebonave. Assets and know-how from both organisations will be deployed to service customers in the Portuguese port. The Dutch ports of IJmuiden and Amsterdam remain the primary focus for Iskes, and the company’s fleet of tugs has been strengthened by the arrival of a number of new vessels over the past year. The 82-tonnes Damen 3212 type tug Mars entered service in the second half of January, following the arrival of Telstar in October. The latter is a hybrid tug built to the Eddy tug design and offers a high degree of manoeuvrability and a low environmental impact. (Source: Tug Technology & Business)

A dvertisement

PORTLAND’S TUGBOATS THE SHEPHERDS OF SHIPS

The port is deep dark as the Cape Grant answers to skipper Allan Geraldene’s touch on the controls and reverses out of its berth. The sound of its engines, up here on the bridge, is a mere grumble. It’s illusory: below decks two great diesel motors, each with 12 cylinders and capable of producing 1400 horsepower, fairly bellow. Big funnels baffle the sound. The Cape Grant’s twin, the Cape Nelson, is sliding into the pre-dawn, too, under the command of Garry John. Work to be done. Together, these two tugs and their various masters and crews herd ships 20 times their size from the ocean into the port of Portland, nudge and bully them to moorings at one of several wharves, and haul and push them out again. The two stubby vessels are the port’s heavy-duty labourers. Portland, Victoria’s first European settlement and the only deep-water harbour between Adelaide and Melbourne, exists largely because it lies within the western crook of Portland Bay, offering shelter from often cruel seas at the far reaches of what is known as the Shipwreck Coast. Space at the wharves is rare. The port is the world’s largest hardwood wood chip exporter. The world’s thirst for mineral sands, grain, softwood logs, aluminium and live animals also keeps the harbour in restless movement, and several large cruise ships arrive each year. This morning the tugs must send the bulk carrier Royal For ward , loaded with wood chips, on its way to China. The Cape Grant nudges up to the ship’s bow and a rope snakes down, enabling integrated rating Paul Westlake and marine engineer Henry Kraak to secure a tow-line. The Cape Nelson does much the same manoeuvre down at the ship’s stern, and soon both tugs are in reverse, hauling the loaded ship off the wharf, turning it to face out to sea. Radio commands go back and forth from the Portland pilot, Altaf Hussain, who is commanding the Royal Forward from its bridge. Once the ship is out to sea, Hussain will clamber down a ladder and return to port aboard the small pilot’s launch. Soon, with the Royal Forward steaming away, the Cape Grant drags from another wharf the China Spirit , loaded high with softwood logs. Allan Geraldene’s light touch on the controls makes it seem so simple, the gentle nudging and the full-power reverse towing in a tight section of the harbour. He’s been working on tugs since 1980 and skippering since 1984. A windless dawn reveals a perfectly calm sea. It is often not like this. In winter and spring, westerlies howl. Big depressions out in the Southern Ocean send swells of five metres into the bay. In summer and autumn, the big blows come from the south and the east, and there is no shelter from them even in this

sheltered harbour. Shepherding cargo ships in a tight harbour with a sudden squall ripping in, turning the towering steel sides of those ships into giant sails, is a tricky science requiring calm nerves and decades of experience. A single ship is typically 55,000 tonnes dead-weight, and is often loaded with another 50,000 tonnes of cargo. The tugs need to be nimble. They are: two propellers driven by those big engines sit within pods that swing 360 degrees, enabling these workhorses to spin on the proverbial sixpence. It is a ballet.

3/27

sheltered harbour. Shepherding cargo ships in a tight harbour with a sudden squall ripping in, turning the towering steel sides of those ships into giant sails, is a tricky science requiring calm nerves and decades of experience. A single ship is typically 55,000 tonnes dead-weight, and is often loaded with another 50,000 tonnes of cargo. The tugs need to be nimble. They are: two propellers driven by those big engines sit within pods that swing 360 degrees, enabling these workhorses to spin on the proverbial sixpence. It is a ballet

EVENT ON THE ROLE OF DIGITAL TECHNOLOGY IN THE SHIPPING SECTOR

The second European Shipping Week is being organised from Monday 27 February to Friday 3 March 2017 in Brussels. As an associated partner of this high level event, the European Tugowners Association is hosting a workshop at the Permanent Representation of Malta headquarters (rue Archimède 25, Brussels) on the morning of the 27th of February (9.3012.30). The event, coorganized by the Maltese EU Council Presidency, will focus on the Role of Digital Technology in the implementation of the Ship Energy Efficiency Management Plan. Discussions should especially take into consideration the existing IT infrastructure, best practices for fuel operation of ships or the role of the EU telecom sector in the increasing digitalization of the maritime industry. Moreover, the European Commission will also present recent developments on digitalisation and more specifically on the efforts to create the framework conditions for a European Maritime Single Window environment. The speakers: Robert Ashdown – IACS; Tore Longva – DNV GL; Martti Alatalo – Danfoss; Harold van Meer – Kotug Smit. Please confirm your participating by sending an e-mail to: tte.maltarep@gov.mt or info@eurotugowners.com. We look forward to seeing you during the 2017 European Shipping Week. (Press Release)

TUG TRAINING CENTRE OPENS ON HUMBERSIDE, UK

Tug and port operations training will be an important part of what Modal Training will offer from its new £7 million (US$9 million) facility in the UK. It has invested in a tug simulator as part of a

large suite of simulation equipment at a new centre in Immingham on the south bank of the Humber. Modal has installed a Kongsberg K-Sim class B tug simulator and is currently building a set of crane simulators that can be used for training in port operations. It has also invested in Kongsberg simulators for teaching ship navigation, dynamic positioning, offshore vessel and engineroom operations. Sam Whitaker, director of Modal and director of strategic projects at the nearby Grimsby Institute said the facility will become a centre of training excellence for the maritime, ports, energy and logistics sectors. “The tug simulator will be used for training Humber pilots and supporting port operations,” he told Tug Technology & Business, adding: “We hope smaller port operators will also use this for multi-skill training.” Tug operations can be taught on a specially designed Kongsberg K-Sim class B bridge simulator. This can be configured for workboat and tug training, and for teaching ship handling and tug-ship interfaces. The software includes hydrodynamic modelling that allows vessels, objects, weather conditions and equipment to behave as they would in real life. The simulator can be used for monitoring and control, thruster and propulsion control and dynamic positioning training. It works in combination with other simulator systems so trainees can operate a tug alongside another team on a ship. Mr Whitaker said Modal Training is the first independent training organisation in the UK to offer such a comprehensive a range of Kongsberg simulators. The full line up of Kongsberg simulators at Modal Training includes: K-Sim class A offshore vessel simulator, with a fore and aft bridge; K-Sim class B tug simulator; K-Sim class B offshore support vessel simulator; K-Sim class C dynamic positioning simulator; K-Sim engine and control room simulator; K-Sim navigation simulator; K-Sim VTS simulator. Modal Training business development manager Ella Brown said the company was also working with Offshore Simulator Centre (OSC) AS in Norway to create a sophisticated crane driver simulator training suite. The suite of equipment will be unique to Modal Training’s facility. “The OSC suite will see individuals train to drive all types of cranes, across a wide range of portside and offshore operations. We can facilitate training for cranes that are used on vessels and rigs, both to move items between the two, or vessel to vessel. The simulators are designed to give trainees the skills and experience they need to work on all of these,” she said. “Importantly, the crane simulators can also be used to simulate operations with bridge and remotely operated vehicles. This will allow whole teams of crane drivers, deck hands and offshore vessel operators to train together in a wide range of critical scenarios.” (Source: Tug Technology & Business)

ACCIDENTS – SALVAGE NEWS

WORK BEGINS TO REFLOAT CARGO SHIPS THAT RAN AGROUND IN SHARJAH DURING STORM

Work has begun to refloat several cargo ships that ran aground in a storm last week in which at least three sailors died. Five vessels were washed up on the coasts of Sharjah and Umm Al Quwain. On Sunday, one cargo ship was being floated at Al Hamriya beach after running aground off Sharjah in bad weather. Another vessel sank in the storm, claiming the lives of at least three Indian sailors, whose bodies were recovered from the sea. Two crewmen were rescued by coastguards and five

were helped from the sinking ship. Two others in the 12man crew remain unaccounted for. Municipality teams and representatives of the company managing one of the other ships are now working on manoeuvring the ship towards the sea to allow tugs to pull it into deeper water to float it. Capt Sanjay Prasher flew in from India to manage the operations to refloat the vessel. “The ship has 18 crew members from India, they have not been harmed or injured during the bad weather. They have been on the ship since it ran aground,” said Capt Prasher. Hawsers from the tugs were attached to the ship and one of the grounded vessel’s anchors raised while the other was dropped to maintain stability as the tugs turned its bow. “It will be a slow process to nose the ship towards the sea. There is sand accumulated around the ship due to it being aground all this time,” said Capt Prasher. “Tugboats can’t pull hard or else the ship would lean to one side, which might be dangerous.” Capt Prasher said: “We are waiting for the high tide. The tide will take much of the ship’s weight making it easier to manoeuvre. “Weather conditions can also affect the process of moving it.” According to his estimates, the ship may need 48 hours to be floated, weather permitting. On the beach, municipality teams and police were coordinating efforts to ensure no environmental issues arose from the operation

APL AUSTRIA CONTINUES TO BURN

A cargo fire on the container ship APL Austria in Port Elizabeth, South Africa continued to burn on Wednesday. South African media reports suggested that the fire had been contained Tuesday night, but video from the scene this morning showed that it continued to smolder belowdecks. The vessel has been brought alongside at the Port of Ngqura, and the responders have removed burned containers from the above-deck stacks to give firefighters better access. As of yet, the responders have not been able to get down to the level of the fire. Port operator Transnet has deployed firefighting-equipped tugs to assist in suppressing the blaze and cooling the hull. Authorities say that

the fire poses no structural danger to the vessel. The vessel is loaded with about 3,000 containers, and the operator says that there is hazardous material cargo on board, including refrigeration gases and paint. European experts in hazmat firefighting have been flown in to help deal with the blaze. Captain Nigel Campbell of the South African Maritime Safety Authority told Herald Live that “we need to understand all of the cargo in the hold to decide on the medium to be used” to put out the fire. He added that the response team has placed less-flammable containers around the area of the blaze to create a firebreak. The fire broke out Monday as the Austria was arriving at the Algoa Bay anchorage. The response teams met her out in the bay, and were later allowed to moor her at Port Elizabeth as a port of refuge. All crew are safe and accounted for. Four nonessential crewmembers were evacuated shortly after the fire broke out, according to the non-profit sea rescue organization NSRI; one of the evacuees had a leg injury and was treated on shore. Belowdecks cargo fires can be difficult to address on container ships, especially on larger vessels with deeper holds. The steel boxes compartmentalize and contain any smoldering cargo, and the location is difficult and dangerous for firefighters to enter. A container fire on the CCNI Arauco in Hamburg last September took 48 hours to put out: repeated attempts to flood the hold with CO2 were not effective, and the response team ultimately had to borrow 45,000 liters of advanced firefighting foam (AFFF) to smother the blaze. Uwe-Peter Schieder, vice chairman of IUMI’s Loss Prevention Committee, says that container fires are even harder to fight under way. “At sea, below-deck fires cannot be fought with water and so CO2 is used instead to displace the oxygen and extinguish the fire. However, if the fire is burning within a container, the box will protect it from the CO2 and so this method of fire-fighting is rarely successful. Currently there are no other methods of fighting a container ship fire below deck [at sea],” he warned last October.

HEAVY LIFT DYNAMICS OF THE SEWOL FERRY SALVAGE

The Sewol was a RoPax vessel built in 1994. She sank off southwest Korea on April 16, 2014 with the loss of 304 lives, many of them schoolchildren. The vessel capsized and sank in 44m water depth, coming to rest on her port side on a level seabed. Divers searched for missing bodies until November, 2015. The last body found was in October. Nine bodies were still missing at the time of writing this paper. They are believed to be inside the wreck, probably in the damaged superstructure area. For salvage planning, OrcaFlex was used to predict dynamic sling tensions under a range of potential operating conditions. The models developed used

7/27

fully coupled analysis with the motions of the Dalihao crane barge being driven by diffraction force RAOs and influenced by the crane hook loads through appropriately modeled sling systems to the submerged Sewol model. Simultaneously, the Sewol model was driven with diffraction force RAOs and was given a seabed ground reaction as well as sling loads from the crane barge. The seabed interface permitted the Sewol to respond in pitch and roll. Heel equilibrium solution during bow lift. Labels indicate vessel frame numbers. Each frame identified is drawn with a different line color in the Excel chart. The frames are shown with the vessel trimmed. Hence Frame 173, in the region where the bow slings attach, appears raised. Frames 0, 6 and 6 are indicated and can be seen to be without any significant seabed contact. The upper short blue arrow indicates the location and magnitude of the combined sling loads. The upper red arrow indicates the location and magnitude of the combined added buoyancy force. The central purple arrow, pointing down, indicates the location and magnitude of the combined weight force. The lower brown arrow indicates the location and magnitude of FG, the ground reaction force. The variable Tpivot, is the transverse distance of FG from the keel. At this distance, FG causes a moment that balances the system such that there is no net heeling moment. The brown trapezoidal area beneath the seabed indicates the reaction pressure that would provide the force FG, if applied over the area of hull calculated to be in contact with the seabed in this load condition. She the complete salvage report

walkway, spilling about 10 gallons of oil discharge. Watchstanders at Coast Guard Sector New Orleans received a call at 3:19 a.m. reporting the incident, and a 45’ response boat medium crew was dispatched from Coast Guard Station Venice at 3:36 a.m. The Coast Guard crew arrived on scene at 4:30 a.m. and transported the lift boat crew back to the Venice station. There were no injuries, according to the Coast Guard. The 87’x19’ cutter Brant arrived at 10:41 a.m. to monitor the Superior Trust, while an MH-65 helicopter aircrew from Air Station New Orleans conducted an overflight. Superior Energy was developing a salvage plan to recover the Superior Trust and has a pollution cleanup company on standby, Coast Guard officials said. I.G. Petroleum, L.L.C., deployed a response vessel to survey the damage to the platform and begin repair

OCEAN RANGER ANNIVERSARY

Today, 15 February, marks the 35th anniversary of the loss of the drilling rig Ocean Ranger and all 84 persons on board. The world’s largest semi-submersible was working on the Hibernia field 166 miles east of St.John’s when it was struck by a severe storm. The rig was supposed to withstand harsh conditions but a sea broke through a portlight washing out the ballast control room. Unable to prevent further flooding, the crew attempted to abandon the rig in appalling conditions, but did not survive. A Royal Commission found numerous faults in the design of the rig, inspection, training and safety procedures. At the time of the loss there were two other drill rigs nearby, Sedco 704 and Zapata Ugland. Both suffered damage, but survived. All three had standby boats in the area, but there was little they could do but assist in recovering bodies. The standby boat for Zapata Ugland was Nordertor. Built in 1976 by Hitzler, Lauenburg, it was owned by Offshore Supply Association. Seaforth Highlander was standby boat for Ocean Ranger. It was built in 1976 by Ferguson Brothers, Port Glasgow, Scotland and was operating for the Seaforth Fednav joint venture. A sister tug/supplier Seaforth Jarl from the same builders in 1975 was lost December 18, 1983 when an improperly secured deck load of chain ran overboard and capsized the vessel. The crew was rescued by Arctic Shiko. Sixty-five miles to the east the Russian Mekhanik Tarasov was struck by the same storm. On a trip from Trois-Rivières, QC to Leneingrad, it attempted to assist in the Ocean Ranger rescue operation, but took a severe list eventually capsizing February 16 with the loss of 32 of its 37 crew. The crew of the Atlantic Project were more fortunate. All survived a fire aboard their vessel between Newfoundland and Nova Scotia February 14, 1982. The ship reached Halifax safely February 15, thus escaping the worst of the storm.

COAST GUARD RESPONDS TO ALASKA TUG GROUNDING

A Coast Guard Station Ketchikan Response Boat— Medium crew and Marine Safety Detachment Ketchikan pollution team responded to the tug boat Samson Mariner when it ran aground while towing a barge in the vicinity of north Tongass Narrows in Rosa Reef, Alaska, Wednesday evening Coast Guard Sector Juneau command center watchstanders received notification via VHF-FM radio from the captain aboard the Samson Mariner that his vessel ran aground and had a minor breach in the hull. Station Ketchikan and pollution responders were immediately launched, arrived on scene, placed boom around the tug and verified that crew of the Samson Mariner plugged the breached hull. The Samson Mariner, which is operated by Samson Tug & Barge Co., Inc. of Sitka, Alaska, has 30,000 gallons of fuel on board and the barge has 40,000 gallons of diesel on board. Three Southeast Alaska Petroleum Response Organization tugs took the barge to Ward Cove where it will be anchored and assessed for damage. No damage to the barge or injuries have been reported.

OFFSHORE NEWS

HISTORIC SUPPLY SHIPS – THE STORFONN

Although the VS 476 is fairly closely related to the VS 469, because of the larger number of the class produced and their longevity in the industry they are worth a mention. Four were built in 1985 and 1986 at the Danish Orskov shipyard all initially owned by Norwegian investors, probably as part of a process, which remained slightly obscure to most of us, known as the KS investment scheme. This was a scheme which gave Norwegian professionals tax breaks if they invested in ships. The first of the four to enter service was the Storfonn (Photographed as Maersk Chieftain in Brazil by Tony Poll in 2005), to be followed by the Kongsgaard, the Kingshav and the Challenger III (Photographed as

Maersk Challenger by Victor Gibson at a North Sea exploration rig in 2007). But of course 1986 was the year when the oil price fell to $8 a barrel resulting in a difficult time for all offshore vessel owners, and in many cases leaving the ships in the direct ownership of the investors. And as in the world today there were advantages for the more innovative shipowners, particularly those with a bit of money in the bank. This resulted in the British offshore support company Ocean Inchcape (OIL) bareboating the four ships, which became the Oil Chieftain, Oil Challenger, the Oil Champion and the Oil Chancellor. My book “The History of the Supply Ship”, chronicles a spokesman for OIL saying, “we are sure we will soon find contracts in the North Sea because there is still a market for that type of anchor-handler”. In fact the four ships were often employed as platform supply vessels. They had a deck area of 633 m2 and other capability included the ability to carry 1400 m3 of diesel and 618 m3 of mud. Their four B&W Alpha engines delivered 14,400 bhp giving them 160 tons of bollard pull. Later at least one of them had an enhanced winch fitted for deep water work out in Brazil. The four ship were purchased outright by Maersk Supply at the end of the five year OIL bareboat charter and became the Maersk Cs. Maersk had been in the business for some years but on a fairly small scale, and it may be that the purchase of these four ship was the start of their major assault on the offshore support business, and in the following weeks we will see further Maersk ships which were in themselves innovative. The four ships were variously employed in the North Sea, in Brazil and in Canada and today two of them are still owned and operated by Blue Star Line. The Maersk Chancellor which has been working in Canada for much of its life departed from Halifax in November 2016 for scrapping in Turkey. The Maersk Champion is still working out in Brazil, apparently defying the

Danish offshore shipowner Maersk Supply Service (MSS) shared a picture through its social media channels on Monday showing three of its AHTS vessels moving the Transocean-owned rig, the Henry Goodrich, off the East Coast of Canada. “The three musketeers,” as the company called them, were moving the rig for Canadian energy company Husky Energy which has the Henry Goodrich under contract until May 2018. The rig has been under contract with Husky since May 2016 on a dayrate of $275,000. It was moved from Norway to Canada in April last year by two of the vessels moving the rig now, the Maersk Detector and Maersk Dispatcher, helped by the ALP Winger. Upon arrival, Husky Energy used the rig at the White Rose oil field development project, some 350 kilometers off the coast of Newfoundland. During this latest rig move operation, the final and youngest member of the Maersk moving trio was the 2015-built Maersk Cutter. According to latest AIS data, all three vessels arrived just offshore St. Johns from the location near the SeaRose FPSO vessel which is operating on the White Rose field. Offshore Energy Today reached out to Maersk Supply Service to seek more information about the operation. We will update the article if and when we receive the company’s response. (Source: Offshore Energy Today)

DOF TO SUPPORT TECHNIPFMC IN PRELUDE FLNG OPS

DOF Subsea has been awarded a contract by Technip Oceania, part of TechnipFMC in Australia, for the provision of multi-purpose support vessel (MSV) Geoholm for Shell’s Prelude FLNG project in Australia. DOF Subsea informed on Tuesday that the 2006-built Geoholm will be required to provide ROV and light construction support services to TechnipFMC in Australia for the Prelude

FLNG water intake riser installation. The company recently secured a Safety Case for Geoholm and the vessel will be available in the Asia Pacific region from the beginning of the second quarter of 2017. John Loughridge, DOF Subsea EVP, Asia Pacific, said, “We look forward to working with TechnipFMC in Australia to deliver a safe and efficient project.” To remind, in December last year, Shell awarded an engineering and project management services contract in support of the Prelude FLNG project to TechnipFMC. The work is being managed and delivered from the company’s operating center in Perth, Western Australi

Bourbon, a marine services provider for the offshore oil & gas industry, has been awarded a pipelay contract by Total for the subsea development of the Hylia project, offshore Gabon. Bourbon said on Tuesday that this is its first pipelay contract awarded by Total Gabon for the engineering, procurement, construction and installation (EPCI) of 25 km of 6” rigid pipeline as part of the Hylia Water Injection Project using Zap-Lok technology. For the execution of this contract, Bourbon is subcontracting key suppliers, mainly Cortez Subsea, for pipelay equipment and Wood Group for the pipeline design and pipelay engineering. According to the company, operations are scheduled to start in the second quarter of 2017 offshore Gabon with an MPSV from the Bourbon Evolution 800 series. ROV services and a PSV, all provided by Bourbon, will also support survey and air diving operations for spool and riser installation. Patrick Belenfant, Bourbon’s Senior VP Subsea Services, commented: “We are very proud of the trust that Total has placed in us for this first pipelay EPCI contract. Such a comprehensive project allows Bourbon and its Gabonese partners to demonstrate our capacity to bring the best integrated services and cost-effective solutions to our clients.” (So urce: Offshore Energy Today)

HARVEY GULF IN SUBSEA PACT WITH HELIX

Gulf of Mexico-focused contractor Harvey Gulf has teamed up with Helix’s marine contracting

business unit Canyon Offshore to provide ROV and survey capabilities on the vessel Harvey Intervention. The 91 meters long multipurpose support vessel (MPSV) was delivered by Florida-based Eastern Shipbuilding in 2012. The newly formed alliance with the ROV operator Canyon, should boost Harvey’s subsea portfolio of services in addition to two subsea newbuilds the Harvey Sub-Sea and the Harvey BlueSea also constructed by Eastern Shipbuilding. The delivery of the Harvey Sub-Sea was due in in 2016, after outfitting and sea trials, while the Harvey Blue-Sea is anticipated for delivery in early 201

WIND UP APPLICATION FILED AGAINST EMAS AMC, EZRA SAYS

Logistics provider Necotrans Singapore filed an application to wind up Ezra Holdings’ associate

NOK 18 million (some $2.1 million) and a net cash effect of approximately NOK 50 million ($6 million) after repayment of the vessel debt. “We are excited to secure the Rem Etive and to continue her deployment for our clients in the APAC region,” said Mark Heine, divisional director marine and member of Fugro’s board of management. “With three multi-year IRM contracts already in place, two of which were awarded in recent weeks, this vessel is the best fit with our fleet to enable us to continue our delivery excellence and efficient performance in subsea IRM projects.” (S ource: Subsea World News)

LAID UP SHIP TO BE CONVERTED INTO STANDBY VESSEL

After 18 months lay up outside Ålesund the “Olympic Poseidon” was to be converted into a standby vessel operated by Høyland Offshore and renamed “Sayan Cloudberry”. As part of the restructuring of Stig Remøy offshore shipping company Olympic Ship, the bank Nordea became owner of three offshore vessels. Two of them, the “Olympic Hera” and “Olympic Commander”, were chartered by the Austevoll shipping company DOF, which also has an option to purchase the vessels. The “Olympic Poseidon” has been sold to Sevnor and was handed over on Feb 13, 2017. She was then moved to Steinsland in Bergenfor installation of firefighting canons and a rescue boat. The vessel, which has no contract to go to, should also be reclassified. The anchor handling characteristics will be retained. The “Sayan Cloudberry” will be operated by Høyland Offshore, which already operates the “Sayan Princess” for Sevnor. The plan is to offer it on term contracts. Funding is by the owners of the Cyprus company Sevnor Ltd. One of the owners is Gunnar Nordsletten, a Norwegian who is living in Russia. The company already owns two ice-class cargo ships that are sailing between Murmansk and Yamal. The Sevnor Ltd. has also entered into a strategic partnership with Viking Supply Ships for Russia where Sevnor is responsible for marketing and commercial operations. In the offshore segment owner they already supply ship Sayan Princess, operating in the spot market in the UK sector. In addition, they have an anchor handling vessels being commissioned in Turkey, which will be ready during the year. Hull and superstructure and 40 containers with equipment bought from SPP in South Korea, after they failed to complete the new building for an Italian company. Neither the contract in wait. – Vier looking for more ships, says Babisnki. Nordea will not comment How the deal turns out business for the seller, is uncertain. According to E24, Nordea had pledged to ship 150 million when they took over ownership before Christmas. Outstanding debt in the ship may have been lower. Press Officer Christian Steffensen in Nordea in Norway say they do not want to comment on the matter. (Source: Vesseltracker)

WIND UP APPLICATION FILED AGAINST EMAS AMC, EZRA SAYS

Logistics provider Necotrans Singapore filed an application to wind up Ezra Holdings’ associate

15/27

company EMAS AMC with the High Court of Singapore on February 6. EMAS AMC is a wholly owned unit of Ezra’s associate Emas Chiyoda Subsea, which is owned 40% by Ezra, 35% by Chiyoda and 25% by NYK. Ezra said in a Singapore stock exchange filing on Tuesday that it was made aware of the application on February 13, following an advertisement published in the Straits Times newspaper. According to the company, the winding up application against EMAS AMC was fixed for hearing on March 3, 2017. EMAS AMC is currently seeking advice on the application while Ezra is assessing the impact of the wind up against EMAS AMC on Ezra as well as on its subsidiaries. In the meantime, Ezra added, the company will hold discussions with relevant parties. Ezra is already under pressure due to EMAS AMC’s missed payment for the hire of Forland’s Lewek Inspector vessel. EMAS AMC’s obligations under the charter party were guaranteed by Ezra. No longer wanting to wait for the payment, Forland served Ezra a statutory demand seeking payments owed for the vessel charter earlier in February, Forland gave Ezra three weeks to make the payment, or otherwise, its solicitors would move for Ezra to be wound up by the court. EMAS also owes payments to Ocean Yield for the vessel Lewek Connector for which the company in December asked for a standstill agreement for December 2016 and January 2017. However, earlier this week, the owner terminated the charter “to protect the company’s legal interest.” Related to the charter termination, Ezra said it is open to entering into discussions with Ocean Yield. First financial quarter delays Ezra made an application to Singapore Exchange Securities Trading Limited (SGX-ST) seeking a 30-day extension to announce the Group’s unaudited Financial Statement for the first financial quarter ended November 30, 2016. The company had since made a further application to SGXST seeking a 60-day extension, instead of a 30-day extension, to announce the 1Q results. Ezra is currently in discussions with various stakeholders and is consolidating its funding requirements. The company said in Tuesday’s SGX filing that if this effort does not achieve a favorable and timely outcome, the Group would be faced with “a going concern issue.” The company added that the outcome of the discussions might materially impact businesses and operations of the Group, and in turn, its Financial Statement for 1Q 2017.

POLARCUS SHOOTS SEISMIC FOR CHARIOT OFF MOROCCO

Chariot Oil & Gas has started 3D seismic acquisition over Kenitra exploration permit (Kenitra) and Mohammedia exploration permits I-III (Mohammedia) offshore Morocco. The survey follows the award of a 75% interest and operatorship of Kenitra, in partnership with the Office National des Hydrocarbures et des Mines (ONHYM) which holds a 25% carried interest. The survey, being conducted by Polarcus, will enable the company to develop the portfolio of drillable prospects and potentially identify additional material prospectivity. This seismic campaign will fulfil the work commitment for the current licence phase on both licences, Chariot said. Kenitra, with an area approximately 1,400 km2 and in water depths ranging from 200 m to 1,500 m, was formerly part of the Rabat Deep offshore exploration permits I-VI (Rabat Deep), in which Chariot now has a 10% interest and a capped carry on the RD-1 well which is anticipated to be drilled in early 2018. Larry Bottomley, CEO of Chariot said: “In line with our strategy we continue to manage our portfolio proactively. This award allows us to capture the extension of the Lower Cretaceous play which spreads from Mohammedia into the Kenitra acreage. With our focus on de-risking our assets, Chariot will develop the drilling inventory on these permits through seismic acquisition which capitalizes on the current excellent seismic contract rates.”

Huisman Equipment has welcomed Siem Helix 2 vessel to its Schiedam facility in the Netherlands. The second well intervention vessel built for Siem Offshore will be outfitted with a Huisman well intervention tower during its stay at Schiedam, Huisman informed throperiod of 7 years, with options to extend the charter up to 22 years. Siem Helix 2 has a length of 158 meters, a beam of 31 meters and an accommodation capacity for 150 peopleugh social media. Siem Helix 2 is a sister vessel to Siem Helix 1, which is currently conducting work offshore Brazil for Petrobras. Both vessels were chartered by the Helix Energy Solutions in 2014 for an initial

Ocean Yield will charter its Lewek Connector subsea vessel to Singapore’s Ezra, under newly agreed terms. The move comes just a few days after the owner had terminated the charter for the vessel it had with Ezra’s cash-strapped subsidiary Emas AMC. For background, Emas AMC in December 2016, requested the standstill agreement relating to the bareboat charter of the ultra- deepwater multipurpose, flexlay subsea construction vessel for December 2016 and January 2017. At the time, Ocean Yield noted EMAS AMC’s restructuring efforts by its parent company EMAS Chiyoda Subsea without confirming whether it would comply to the request or not. Emas AMC is a subsidiary of Emas Chiyoda Subsea, which, in turn, is owned 40% by Ezra Holdings Ltd., 35% by Chiyoda Corporation and 25% by Nippon Yusen Kabushiki Kaisha (“NYK”). EMAS-AMC AS’ obligations under the charterparty for the Lewek Connector are guaranteed by Ezra Holdings Limited. On Monday, February 13, Ocean Yield said that, in order to protect the company’s legal interest, a notice of termination related to the bareboat charter of the 2011-built Lewek Connector has now been served. The company then saud it was still in talks regarding a a potential short-term contract for the vessel to a related company of Ezra Holdings at a reduced rate while a long-term solution is being discussed. This has now materialized as Ocean Yield on Thursday said that it entered into a contract for the Lewek Connector with a related company of Ezra for a period of four months at a rate of $40,000 per day. Ocean Yield also said it would continue to participate in the discussions regarding a financial restructuring of the EMAS Chiyoda Subsea Group. W i n d u p p e t i t i o n Apart from its dealings with Ocean Yield, EMAS AMC has been a subject of a wind-up petition filed by logistics provider Necotrans Singapore. Necotrans filed an application to wind up Ezra Holdings’ associate

company EMAS AMC with the High Court of Singapore on February 6. According to the company, the winding up application against EMAS AMC has been fixed for hearing on March 3, 2017. Ezra is already under pressure due to EMAS AMC’s missed payment for the hire of Forland’s Lewek Inspector vessel. EMAS AMC’s obligations under the charter party were guaranteed by Ezra. No longer wanting to wait for the payment, Forland served Ezra a statutory demand seeking payments owed for the vessel charter earlier in February, Forland gave Ezra three weeks to make the payment, or otherwise, its solicitors would move for Ezra to be wound up by the court. (Source: Offshore Energy

company EMAS AMC with the High Court of Singapore on February 6. According to the company, the winding up application against EMAS AMC has been fixed for hearing on March 3, 2017. Ezra is already under pressure due to EMAS AMC’s missed payment for the hire of Forland’s Lewek Inspector vessel. EMAS AMC’s obligations under the charter party were guaranteed by Ezra. No longer wanting to wait for the payment, Forland served Ezra a statutory demand seeking payments owed for the vessel charter earlier in February, Forland gave Ezra three weeks to make the payment, or otherwise, its solicitors would move for Ezra to be wound up by the court. (Source: Offshore Energy Today )

PGS NARROWS LOSS AS REVENUES SINK ON LOW PRICING

Petroleum Geo-Services (PGS), a marine geophysical company, narrowed its fourth quarter 2016 loss while its revenues dropped by 33 pct due to low contract pricing. In its quarterly report on Thursday, the geophysical company posted a smaller net loss for the fourth quarter of 2016 totaling $156.1 million, versus $334.6 million in the year-before period. PGS’ net loss before tax for 4Q 2016 was $118.7 million, compared to $357.1 million in the prior-year quarter. The company recorded impairment charges, excluding impairment of MultiClient library, of $12 million for the full year 2016 and $7.8 million in 4Q 2016, primarily relating to adjustments to the expected schedule for returning cold-stacked vessels to operation. Jon Erik Reinhardsen, PGS President and Chief Executive Officer, said: “As a result of low activity levels and continued excess supply of vessels, the marine contract market remained challenging through 2016.” Further, PGS’ revenues during the last quarter of 2016 decreased by $75.2 million, or 33%, totaling $154.1 million, compared to $229.3 million in the corresponding period of 2015. This reflects a 33% reduction in marine contract revenues and a 38% reduction in total MultiClient revenues. Lower marine contract revenues in 4Q 2016, compared to 4Q 2015, were due to low pricing for contract work, more nonchargeable vessel time and limited capacity allocated to marine contract activities, PGS explained. MultiClient pre-funding revenues decreased $47.1 million in 4Q 2016, or 48%, compared to 4Q 2015, owing to less capacity used for MultiClient surveys and weaker sales from surveys in the processing phase. MultiClient late sales revenues in 4Q 2016 decreased by $15.1 million, or 22%, compared to 4Q 2015. MultiClient sales vary significantly between quarters and regions and the company said it had relatively greater success in realizing sales in 3Q than it had in 4Q. More stable oil price ‘to benefit seismic market’ Going forward, PGS said it expects the higher and more stable oil price and improved cash flow among clients, combined with an increasing constraint on available streamers in the industry, to benefit the marine 3D seismic market fundamentals. The company expects the volume of marine 3D seismic acquired by the industry to increase in 2017 compared to 2016, partly driven by an expected increase of 4D streamer monitoring surveys and more MultiClient 3D projects. Based on the current operational projections and with reference to disclosed risk factors, PGS stated it expects full year 2017 gross cash cost to be approximately $700 million. According to the company, the increase from 2016 is primarily driven

18TH VOLUME, NO. 15 DATED 19 FEBRUARY 2017

by more operated capacity and an expected increase in fuel prices, partly offset by further cost reductions. MultiClient cash investments are expected to be approximately $275 million, with a prefunding level of approximately 100%. Approximately 55% of the 2017 active 3D vessel time is expected to be allocated to MultiClient acquisition. Capital expenditure is expected to be approximately $150 million, of which approximately $85 million relates to completion of the new build Ramform Hyperion, which is currently under construction at the shipyard Mitsubishi Heavy Industries Shipbuilding in Japan. It is scheduled to be delivered in March 2017. The order book totaled $215 million at December 31, 2016 (including $113 million relating to MultiClient), compared to $190 million at September 30, 2016 and $240 million at December 31, 2015

18TH VOLUME, NO. 15 DATED 19 FEBRUARY 2017

19/27

by more operated capacity and an expected increase in fuel prices, partly offset by further cost reductions. MultiClient cash investments are expected to be approximately $275 million, with a prefunding level of approximately 100%. Approximately 55% of the 2017 active 3D vessel time is expected to be allocated to MultiClient acquisition. Capital expenditure is expected to be approximately $150 million, of which approximately $85 million relates to completion of the new build Ramform Hyperion, which is currently under construction at the shipyard Mitsubishi Heavy Industries Shipbuilding in Japan. It is scheduled to be delivered in March 2017. The order book totaled $215 million at December 31, 2016 (including $113 million relating to MultiClient), compared to $190 million at September 30, 2016 and $240 million at December 31, 2015. (Source: Offshore Energy Today)

Advertisement

HORNBECK SAYS REFINANCING NEEDED TO REPAY ITS DEBT

Hornbeck Offshore in the US says it has sufficiently liquidity to fund operations through the end of 2018, but needs to refinance to meet upcoming debt obligations. Announcing fourth quarter 2016 results, Hornbeck Offshore said that, as of 31 December 2017 it had a cash balance of US$217.0 million. In addition, the company has an undrawn revolving line of credit with a current borrowing base of US$200 million which, under certain circumstances, is likely to be capped at US$75 million during a portion of fiscal 2017. This credit facility is available for all uses of proceeds, including working capital, if necessary. The company said that although it remains in compliance with all covenants under the facility, its ability to access the full amount of the borrowing base is subject to an anti-cash hoarding provision that, pro forma for deployment of the use of proceeds, limits its cash balance to US$50 million at any time the facility is drawn. The company projects that, even with the current depressed operating levels, cash generated from operations together with cash on hand should be sufficient to fund its operations and commitments at least through the end of its current guidance period ending 31 December 2018. However, it does not currently expect to have sufficient liquidity to repay three tranches of unsecured debt that mature in fiscal years 2019, 2020 and 2021, respectively, unless it

20/27

can refinance or restructuring the debt. “Refinancing in the current climate is not likely to be achievable on terms that are in line with the company’s historic cost of debt capital,” said Hornbeck. “The company remains fully cognizant of the challenges currently facing the offshore oil and gas industry and continues to review its capital structure and assess its strategic options.” As of 31 December 2016, the company had 44 offshore support vessels and two multipurpose supply vessels stacked. For the three months ended 31 December 2016, the company had an average of 46.5 vessels stacked compared to 26.8 vessels stacked in the prior-year quarter and 44.1 vessels stacked in the sequential quarter. The company recorded a net loss for the fourth quarter of 2016 of US$19.2 million compared to a net loss of US$2.7 million in the same period 12 months ago, and a net loss of US$16.5 million for the third quarter of 2016. Revenues were US$41.9 million for the fourth quarter of 2016, a decline of US$46.8 million, or 52.8 per cent compared to the same period in 2015

WINDFARM NEWS – RENEWABLES

OLYMPIC CHOOSES KONGSBERG K-WALK KIT FOR OLYMPIC ORION

Norway’s Olympic Shipping has chosen Kongsberg Maritime’s new K-Walk integrated vessel gangway solution for installation aboard the multipurpose offshore vessel (MPSV) Olympic Orion to provide transfer of personnel and materials between the vessel and offshore wind turbines. K-Walk will be integrated with the advanced Kongsberg Information Management System (K-IMS) and the existing K-Pos Dynamic Position system on board Olympic Orion, which will be upgraded as part of the installation in the latter half of 2017. The system is activated prior to entering a wind turbine’s safety zone, reducing vessel speed and launching the K-Walk hook up process during approach. Because of the integration with the DP, the gangway is said to be able to move into position while the vessel is still moving, positioning it safely as the vessel arrives on station. Kongsberg said that the integration of K-Walk with K-IMS enables in-depth mission planning, resulting in increased productivity and efficiency by finding the most preferred route for increased service capability within the wind farm. The K-Walk solution for Olympic Orion is also expected to improve time for mobility and safety with an integrated lift system for transfer of people and goods, including electric trolleys, currently under design, for movement of pallets across the gangway. “K-Walk provides Olympic Orion with total oversight of route planning and gangway hook-up operations. It enables better real-time and long-term management decisions, and empowers safer, more predictable, and efficient operations through reduced human interaction and automation based on the deep integration of critical systems on board,” said Stene Førsund, Executive Vice President, Global Sales and Marketing, Kongsberg Maritime. Bjørn Kvalsund, COO of Olympic Subsea, said that this gangway solution might be installed on several other Orion vessels ”in order to provide W2W services into an expanding and interesting market segment.” (Source: Offshore Wind)

MV FLATHOLM GETS BUSY AT GALLOPER OWF

Lowestoft based multipurpose vessel MV FlatHolm finished off a busy year in 2016 with a successful charter to James Fisher Marine Services Ltd, undertaking a variety of service activities in connection with the Galloper Offshore Wind Farm during November and December. The Galloper project was busy, last year, with turbine foundation preparation and MV FlatHolm provided daily cover, making sure the site was clear and checking for hazards and obstructions which might have hindered operations with the scour protection rock placement work. Being based locally in Lowestoft, MV FlatHolm was able to be on standby for any situation which might require immediate deployment, offering efficient and cost effective support whenever needed. The versatile 24m vessel also completed operations with the deployment of two Triaxiswaverider buoys before the planned charter conclusion. (Source: MarineLink)

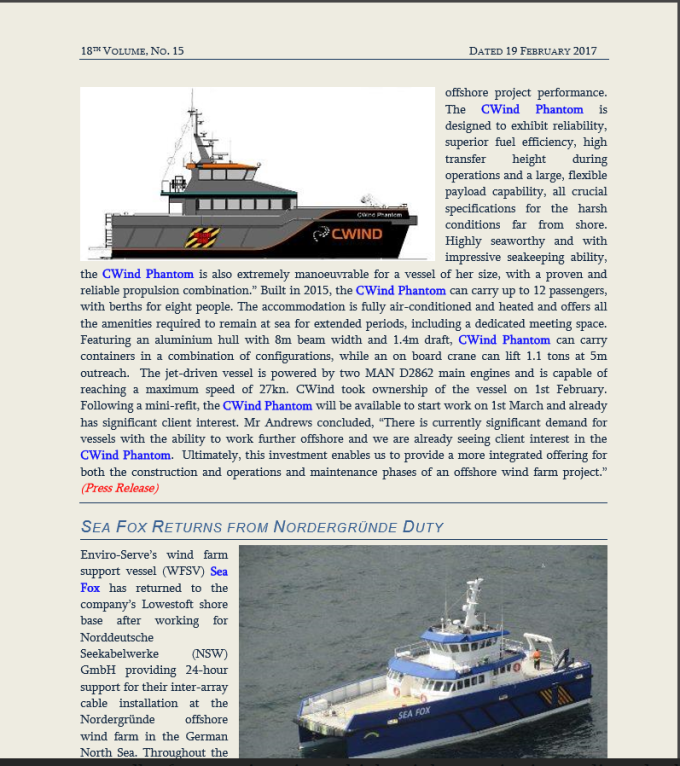

CWIND INVESTS IN LARGEST CREW TRANSFER VESSEL TO DATE

CWind, a leading provider of services to the offshore wind industry, announced today that it has invested in the Company’s largest crew transfer vessel to date. Newly named as CWind Phantom, the 27.4m catamaran can hold 20,000 litres of fuel and has a 20 ton cargo capacity, making her suitable for longer stretches of work at wind farms located further from shore. This investment demonstrates the Company’s ability to evolve with the changing market. CWind’s fleet now totals 18, with access to additional cable installation and maintenance vessels via CWind’s parent company, Global Marine Systems Limited. “Our experience on the world’s largest offshore wind farms has helped us build a diverse range of vessels that meet the changing needs of our valued clients,” said Lee Andrews, Managing Director for Power at CWind. “Transporting technicians quickly, safely and comfortably to and from sites, even in tough weather conditions, is critical to

wind farm, developed by wpd, will feature 18 Senvion’s 6.15MW turbines. At the end of December 2016, MPI Enterprise completed the installation of the 18 turbines at the site. Initially planned to be commissioned by the end of 2016, the wind farm will be put into full operation in the second quarter of 2017. The commissioning was postponed due to BVT, the company in charge of the wind farm’s substation, entering insolvency. (Source: Offshore Wind)

Seacat Enterprise, a 27metre High Speed Utility Vessel (HSUV) built for the Cowes-headquartered offshore energy support vessel operator, Seacat Services, has started sea trials on Thursday, 16 February, according to South Boats IoW, the builder of the vessel. Seacat Enterprise is a product of a long-term collaborative R&D programme between South Boats IoW and Alicat Marine Design, and will be the first vessel of its kind in Seacat Services’ fleet and on the offshore wind market. The new catamaran, launched on 12 January, has a number of structural modifications and features that enable the vessel to carry up to four 20-foot containers, along with a full complement of 24 safety-trained personnel and six crew. A new stern fender system allows cargo to be unloaded from the aft deck via crane, increasing the range of options available for the transfer of key equipment at port and at sea. This system is coupled with an all new dynamic bow fender design. Seacat Enterprise’s increased fuel capacity is said to allow the vessel to remain operational for extended periods between port calls. Seacat Eneterprise’s sister vessel, Seacat Weatherly, is scheduled for delivery later this year. (Source: Offshore Wind)

Seacat Enterprise, a 27metre High Speed Utility Vessel (HSUV) built for the Cowes-headquartered offshore energy support vessel operator, Seacat Services, has started sea trials on Thursday, 16 February, according to South Boats IoW, the builder of the vessel. Seacat Enterprise is a product of a long-term collaborative R&D programme between South Boats IoW and Alicat Marine Design, and will be the first vessel of its kind in Seacat Services’ fleet and on the offshore wind market. The new catamaran, launched on 12 January, has a number of structural modifications and features that enable the vessel to carry up to four 20-foot containers, along with a full complement of 24 safety-trained personnel and six crew. A new stern fender system allows cargo to be unloaded from the aft deck via crane, increasing the range of options available for the transfer of key equipment at port and at sea. This system is coupled with an all new dynamic bow fender design. Seacat Enterprise’s increased fuel capacity is said to allow the vessel to remain operational for extended periods between port calls. Seacat Eneterprise’s sister vessel, Seacat Weatherly, is scheduled for delivery later this year. (Source: Offshore Wind)

18TH VOLUME, NO. 15 DATED 19 FEBRUARY 2017

24/27

DREDGING NEWS

DREDGING AFRICA LAUNCHES NEW DREDGER

Dredging Africa Pty based in Pretoria, South Africa, recently completed construction of the cutter dredge Mvubu – 450. According to the company, the dredger – specifically designed for the South African conditions – was launched on the 19th of January 2017 in Cape Town. Commissioning and fine tuning of the dredge systems was completed by the end of January. DA001 or Mvubu 450 as she is affectionately known was specifically designed to clean lined dams. It has a specially adapted horizontal auger to carry material to the center of its cutter assembly were the pump mouth awaits the incoming material to be pumped away. This cutter is equipped with specially designed cutter teeth to loosen hard material and with high pressure jet nozzles to loosen and fluidize tough material. A set of stainless steel wheels prevent the cutter mechanism to come in contact with the plastic lining on the bottom of lined dams. This is further avoided by the stainless steel protective cage over the front of the cutter shroud. Forward and backward travel is facilitated by a treble winch system running along a navigation cable. Mvubu 450 has capacity to pump 450m³ of slurry per hour against 43m total dynamic head at 1400RPM. Power is provided by a Scania industrial diesel engine of 276kW at 1800RPM. Control of the dredge is done by state of the art systems including engine management system, Deap Sea Controller, a SCADA system, pressure sensing and flow rate instrumentation, a nuclear density measuring instrument and other controls. (Source: Dredging Today)

YARD NEWS

LAKE ASSAULT TO BUILD PITTSBURGH FIREBOAT

Lake Assault Boats, a leading manufacturer of purpose-built and mission-specific fire and rescue boats, has been chosen to construct a 34-foot fireboat by the Pittsburgh Bureau of Fire in Pittsburgh, PA. The fireboat will respond to emergencies and help manage fires on waterways, waterfronts, rail lines, and marinas that lie along the Allegheny and Monongahela Rivers, which join together in Pittsburgh to form the Ohio River. The contract is valued at more than $540,000. The craft will be delivered in summer 2017. “We are thrilled to be appointed by the City of Pittsburgh and its Equipment Leasing Authority to engineer and construct this extremely powerful fireboat to protect resources that lie along the city’s iconic riverfront areas,” said Chad DuMars, Lake Assault Boats vice president of operations. “Our team is especially excited to manufacture the first fireboat in its class capable of pumping up to 3,000 gallons of water per minute.” The 34-foot fireboat is a deep V-hull

DATED 19 FEBRUARY 2017

25/27

borisblog50 features excellent outward visibility and includes a 15,000 BTU rooftop AC unit, an adjustable (and full suspension) operator’s seat, additional bench seating, SCBA mounting brackets, a chart table with storage, and a cuddy cabin for general storage. The craft also features a full spectrum of Garmin (GRMN) electronics, including chart plotter, HD radar, sonar, and a forward looking infrared (FLIR) system, all controlled through 12- and 16-inch touchscreens.Other notable features include a full complement of LED floodlights and spotlights, a raised engine compartment/work deck, an automatic engine compartment fire suppression system, a hinged radar arch, dive bottle racks, and a removable canvas awning. Once delivered, Lake Assault will provide three days of onsite training with Pittsburgh Bureau of Firepersonnel. DuMars added, “Pittsburgh hasn’t had a fireboat in service in more than forty years, and this purchase reflects a major commitment by the city to better protect vital resources that simply can’t be reached by traditional firefighting apparatus.

26/27

were built by Krasnoye Sormovo shipyard to Damen design), eight CSD (one of them, CSD 650, was built in Russia), 38 dredger pumps and other equipment,” said Olivier Marcus. The company has designed a range of TSHD ships for dredging operations in water areas of ports, canals, rivers and lakes. Damen Shipyards Group (with its Head Office in Gorinchem, the Netherlands) operates 40 ship- and repair yards employing 9,000 people worldwide. Damen has delivered more than 6,000 vessels in more than 100 countries and delivers approximately 160 vessels annually to customers worldwide. Damen specializes in construction of tugs, boats, patrol vessels, highspeed craft, cargo ships, dredgers, platform service vessels, oil spill response ships, frigates and super yachts. ( Source : Portnews )

ONEZHSKY SHIPYARD TO LAUNCH THE FORTH BOAT OF PROJECT ST23WIМ ON 21 FEBRUARY 2017 ССЗ

Onezhsky Shipbuilding, Ship Repair Yard (Petrozavodsk, Republic of Karelia) is going to launch the forth boat of Project ST23WIМ (Hull No 104) named Yevgeny Vasilyev on 21 February 2017, Vladimir Maizus, Director General of the shipyard, told IAA PortNews on the sidelines of the 4th International Forum of Dredging Companies which opened in Moscow today, 15 February 2017. The ship was designed by the Design Bureau of Marinetec Group. There is a project to build six boats of this design. The boats are intended for the delivery of pilots, commissions and crew members to other vessels and for transportation of cargo. Onezhsky Shipbuilding, Ship Repair Yard (Onega Shipyard) was founded in 2002 on the basis of shiprepair facilities of the Belomorsky-Onezhsky Shipping Company, formed in 1944. In 2011, after the enterprise management dismissal the production stopped, and the company went bankrupt. In late 2014 the enterprise was transferred to the state ownership and resumed its shipbuilding / repair activit

One thought on “ISKES EXPANDS ITS OPERATING HORIZON”